Investment expert Hugo Ferrer explains why he believes Gold will rise to $4,000 per ounce (+100%) from here and within 3 years. Here is his detailed explanation:

Full disclosure: in August 2021 he said that Gold was going to go through the roof and in dollars it is -2% since then and in euros +12%. So it didn’t go through the roof.

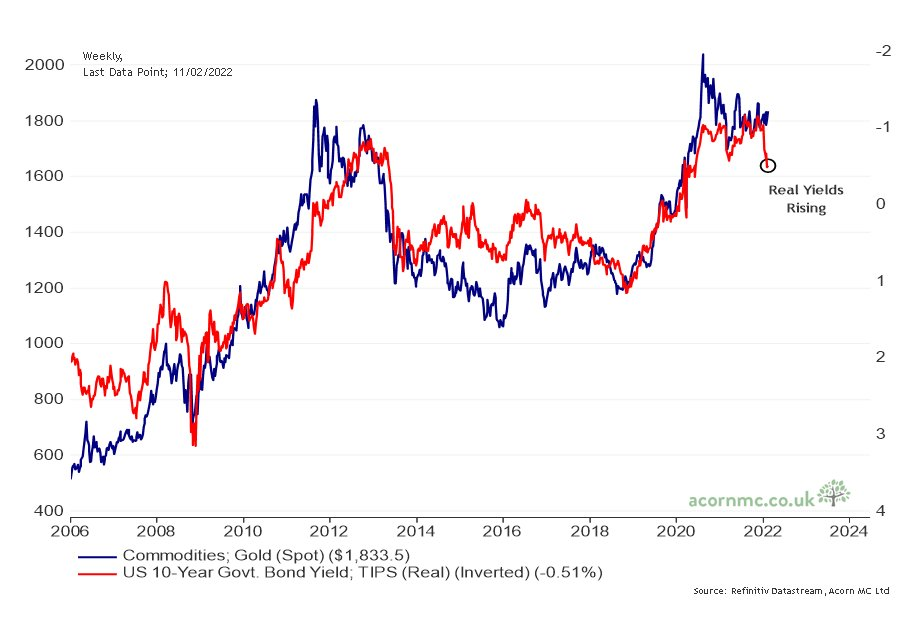

Gold is mainly driven by real interest rates, or rather by long-term expectations of real interest rates. Real interest is what you have left on the coupon of a bond after deducting inflation.

But the market doesn’t care much about what happens in the present, so it’s not as simple as saying that the US sovereign bond yields 4% and since inflation is 7.7%, saying that the real interest rate is -3.3%. No, it doesn’t work like that.

The market is a MECHANISM OF DISCOUNTING FUTURE EXPECTATIONS. So what it cares about is long-term real rates. That is, the difference between EXPECTED long-term inflation and ESTIMATED long-term interest rates.

Hence, voila, long-term real interest rates (in red and inverted for didactic reasons in the chart below), correlate strongly with gold. In fact, they are the cause.

Then, the dollar’s greater strength or weakness (its denominator) is important, but it is rather short term and very secondary. And, of course, it is not at all relevant to the demand for Gold in India or other things that are normally reported.

Gold moves according to real interest expectations, which is the same as saying that gold moves according to whether the market estimates whether there is going to be MORE OR LESS FINANCIAL REPRESSION.

In his August 2021 analysis he was not taking into account that this was going to be an inflationary bear market, something he understood later as he has explained many times. But now he has much more conviction that Gold is going to go “to the moon”.

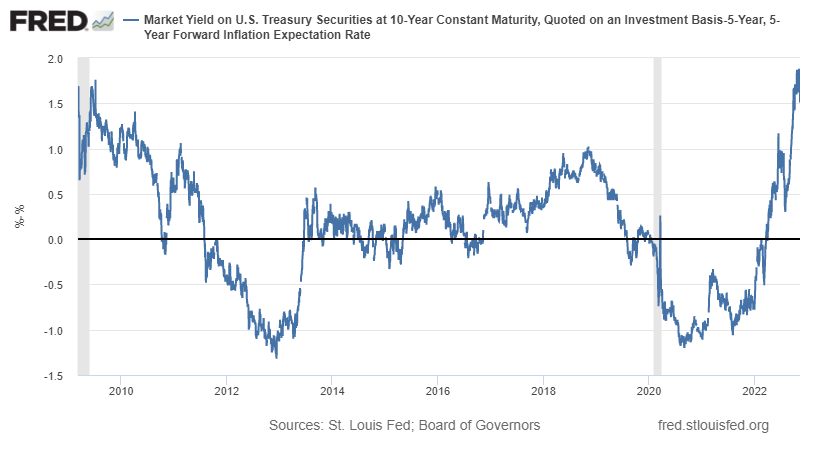

In an inflationary bear market, the Fed raises rates aggressively and with that real rates rise, because the rate expectation part rises more strongly than the inflation expectation part. Right now the situation looks like this.

And what he is saying is that he thinks that from this situation of very positive real interest rates, we are going to go back to negative real rates. Long-term inflation expectations will remain at similar levels, but rates are going to come down quite a bit over the next 24 months.

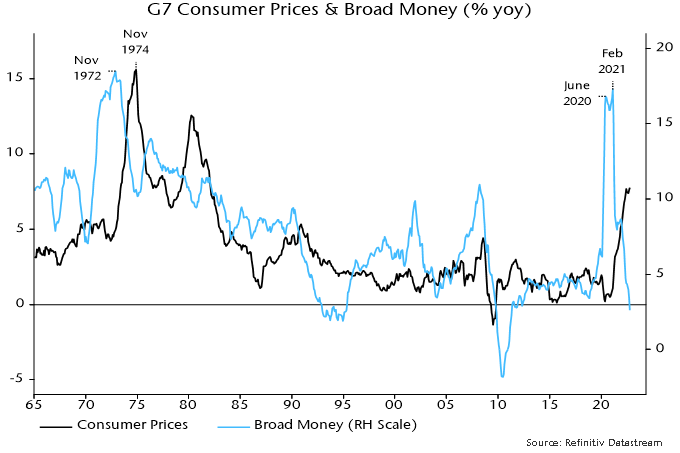

And why do you think long-term real rates are going to turn negative again? Because he has come to the conclusion that the current inflation is temporary. It was the product of the paralysis and fear of the pandemic and its economic consequences.

Money was flowing everywhere, and in fact that fuelled the bubble of non-profits and cryptocurrencies. Money in circulation grew at rates not seen since the 1970s. Hence the high inflation.

But now, as we can see in the graph above, the opposite is happening. The growth of money in circulation is negative. And inflation follows money growth with a lag of 18 to 32 months.

This means that if money growth is negative now, by 2024 and beyond, inflation will be at rock bottom. This is what monetary and fiscal tsunamis are like. First comes the big wave and then the tide goes out. Every action has its reaction.

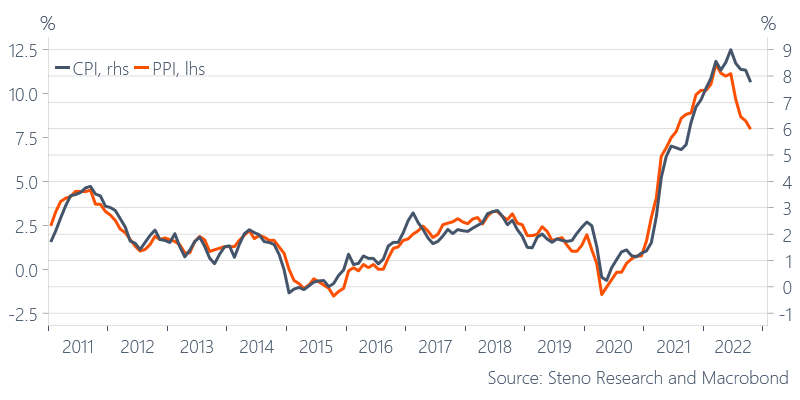

And why is the time from now? Because we have already seen the tipping point for inflation in the US (the locomotive of everything). Both in prices in general and in producers.

And if we look at the breadth of inflation components, most of them are already moderating.

And what happens when inflation starts to moderate? The market starts to sense that the Fed’s rate hike cycle is coming to an end, i.e. the peak of the financial repression is close at hand.

What makes you think that Gold is rising by +9% this November? From the fact that it smells the end of rate hikes and, maybe later on, that they will go down as well. [monthly chart] [monthly chart

Gold, tends to rally strongly when the FED rate cycle (in red) comes to an end, and then continues to rally strongly when rates start to fall. Just the smell of “end of rate hikes” is enough.

For example, the FED stopped raising rates in 2006, from that moment until 2010, when the Great Financial Crisis began to abate, gold rose 100%, from $600 to $1,200. And in the last decades of real rates tending towards the negative, it has usually risen that much.

Now I think it will go up again, because we went from a very restrictive monetary policy, to one that is going to go back to the way it was, with rates close to 0. Structurally nothing has changed in the long run. Demographics and productivity are horrible.

This inflation thing has been a tsunami, action and reaction, but no long-term structural change. And if everything goes back to the way it was, Gold (and its cousin silver) is going to skyrocket. And I think the time is now.

What do you think about this analysis? Leave a comment.